FRBM Act 2003 & Finance Commission

Fiscal Responsibility Budget

1.Fiscal responsibility budget management act was enacted in 2003.

1.Fiscal responsibility budget management act was enacted in 2003.

2.Its establishment was recommended by yaswant sinha commite.

3.Its objective is to reduce fiscal deficit and eliminate primery deficit by 2008-2009.

4.Bring down the fiscal deficit to 3% by 2008.

5.Objective is to move towards balance budget multiplier.

6.Targets of FRBM ACT

A.Revenue deficit:-

Date of elimination - 31 march 2009

Postponed from 2008

Minimum annual reduction - 0.5 % of GDP

Postponed from 2008

Minimum annual reduction - 0.5 % of GDP

B. Fiscal deficit:-

Ceiling - 3% of GDP by march 2008

Ceiling - 3% of GDP by march 2008

Minimum annual reduction - 0.3 % of GDP

C.Total Debt -

9% of GDP

Target increased from original 6 % requirement in 2004 2005

9% of GDP

Target increased from original 6 % requirement in 2004 2005

Annual reduction - 1% of GDP

In 2016 N.K.Singh took the review of FRBM ACT and their targets are following:-

In 2016 N.K.Singh took the review of FRBM ACT and their targets are following:-

a.Toreduce fiscal deficit

* 3% down to 2020

* 2.8% down to 2020 - 2021

* 2.5 % of GDP by 2023

High GST mopup may take goverment closer to fiscal deficit target to reduce 3.4 % of GDP.

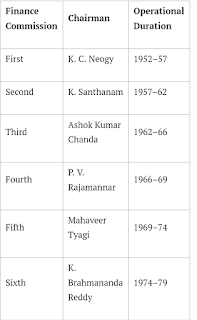

Finance commission

1.Finance commission was establish in 1951 under article 280.

1.Finance commission was establish in 1951 under article 280.

2.It is a statutory body.

3.It is set up after every five year.

4.It constitutes 5

members with 1 chairmen.

5.In 2017 15th finance commission has been set up under the chairmenship of N.k. singh . who represent report for 2020 to 2025.

6.Main task of 15th finance commission is to strenghten copperation federation, improve the quality of public spending and protect fiscal quality.

SOME IMPORTANT ARTICLES OF FINANCE COMMISSION

1.Article 280 -Its establishment

1.Article 280 -Its establishment

2. Article 268-Taxes were imposed by centre goverment but collected by state goverment.

3. Article 269-Taxes levid by centre but assign to state

4. Article 270-Taxes levid and collected by centre but share to state

5. Article 271-Surcharge

6.Article 275 -Grant from centre to state ( grant in aid are given from consolidated funds)

7. Article 280 -Expanditure by union from its revenue

14th finance commission

1. 14th finance commission was constituted under article 280 of constitution january 2013 under chairmenship of Y.V Reddy for the year 2015 - 2020.

2. improved share of the states in central divisible pool from existing 32% to 42% us biggest ever boost in verticle devolution .

3. 12th and 13th finance commission recommended state share of 30.5% and 32% .

4 . 14th finance commission included two new parameters

a. 2011 population

b . forest cover

and excluded fiscal discipline variables

5. sevral other types of grants - grants to rural and urban local bodies a perfomance grant grant for disaster relief revenue deficit

6. transfer of sum 5.3 lakh crore

7. no recommendation regarding sector specific grant unlike 13th finance commission.

8.Horizontal devolution of tax in 14th finance commission

1. population 2011 - 10%

2. income distance - 50%

3. area - 15%

4. forest cover - 7.5%

9. Balancing fiscal autonomy and fiscal space .

14th finance commission

1. 14th finance commission was constituted under article 280 of constitution january 2013 under chairmenship of Y.V Reddy for the year 2015 - 2020.

2. improved share of the states in central divisible pool from existing 32% to 42% us biggest ever boost in verticle devolution .

3. 12th and 13th finance commission recommended state share of 30.5% and 32% .

4 . 14th finance commission included two new parameters

a. 2011 population

b . forest cover

and excluded fiscal discipline variables

5. sevral other types of grants - grants to rural and urban local bodies a perfomance grant grant for disaster relief revenue deficit

6. transfer of sum 5.3 lakh crore

7. no recommendation regarding sector specific grant unlike 13th finance commission.

8.Horizontal devolution of tax in 14th finance commission

1. population 2011 - 10%

2. income distance - 50%

3. area - 15%

4. forest cover - 7.5%

9. Balancing fiscal autonomy and fiscal space .

Comments

Post a Comment